What is credit and how does it relate to your credit score?

Credit is money that you can borrow with the intention that you eventually pay it back. Depending on how well you use and pay back your credit determines your credit score. Your credit score is a number that lenders use to determine whether you are either a risky or safe person to lend to when you decide to make a big purchase; Something like a car or house.

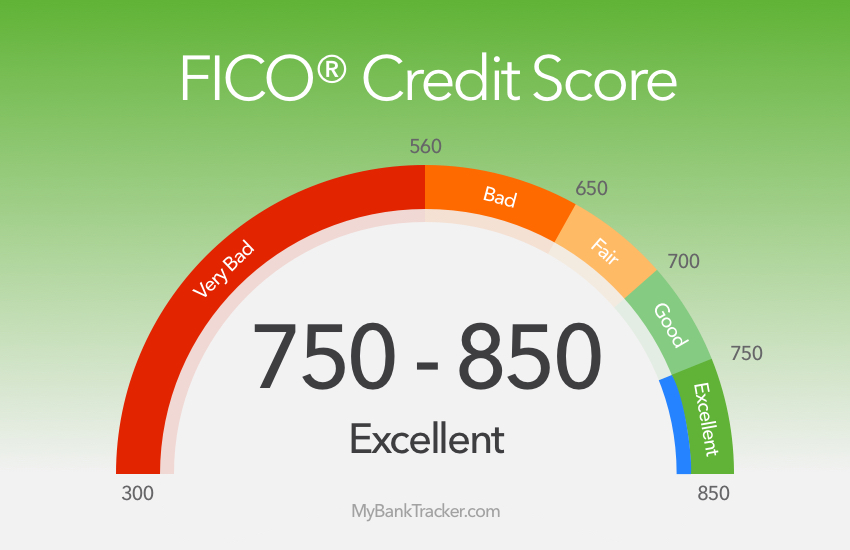

What is the range of credit score?

Credit score ranges from 300 all the way to 850. From 300-560 is considered terrible, 560-650 is bad, 650-700 is average, 700-750 is good, and beyond 750 is considered excellent.

What factors influence your credit score?

Factors that affect your credit score include actions like how often you are using your credit, how quickly you pay off the money you owe, or even just simple things like checking your credit score.

How is your score calculated?

Two of the most important factors that determines your score is your payment history and also how much you owe. They use these along with other parts of your credit report to determine your credit score.